Gst rate changes 2025

- Rate changes affect the entire supply chain—from manufacturers’ working capital to dealers’ ITC and customer pricing.

- Timing of supply, invoicing, and payment is critical under Section 14 of the CGST Act to determine applicable rates.

- ITC implications are significant—reversals, blocked credits, or adjustments must be managed carefully for compliance.

| Industry | No. of Items (approx.) | Old Rate | New Rate | Remarks / Coverage |

|---|---|---|---|---|

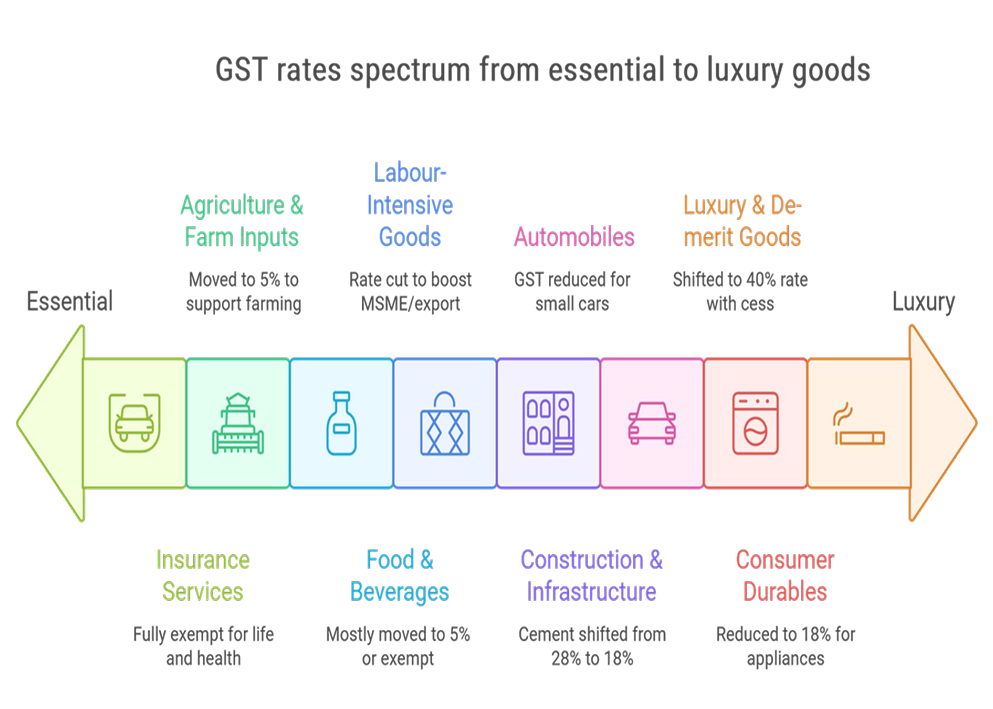

| Food & Beverages | 75 | 12% / 18% | 5% / | Milk, paneer, curd, bread, roti, khakhra, bhujia, namkeens, pasta, noodles, chocolates, packaged juices, soft drinks; most moved to 5% or exempt. Aerated drinks/alcohol excluded. |

| Health & Pharma | 58 | 12% / 18% | 5% / | Lifesaving medicines, critical illness drugs, vaccines, cancer medicines, health insurance policies, medical devices—reduced or exempted. |

| Labour-Intensive Goods | 57 | 12% / 18% | 5% | Handicrafts, leather goods, footwear, coir products, jute, khadi products, wood, etc.—rate cut to boost MSME/export. |

| Agriculture & Farm Inputs | 34 | 12% / 18% | 5% | Tractors, farm machinery, irrigation equipment, fertilizers, pesticides, animal feed—moved to 5%. |

| Construction & Infrastructure | 2 (major) | 28% | 18% | Cement and related inputs shifted 28% → 18% (major cost saver for infra). |

| Automobiles | 4+ | 28% | 18% | Small cars, two-wheelers, motorcycles—GST reduced. Larger SUVs remain at higher rate. |

| Consumer Durables | 5+ | 28% | 18% | ACs, refrigerators, washing machines, televisions—reduced to 18%. |

| Insurance Services* | 2 | 18% | Exempt | Life insurance and health insurance policies—fully exempt. |

| Luxury & De-merit Goods | 10 | 28% + cess | 40% (new slab) | Pan masala, gutkha, tobacco, bidi, related products—shifted to 40% (with cess adjustments). Effective later due to compensation-cess settlement. |

| Entertainment & Hospitality | Few | 18% / 28% | 18% / 5% | AC restaurants and some amusement services rationalised. |

| Miscellaneous | Multiple | 12% / 18% | 5% | Marble, granite, toys, sanitary napkins, footwear under ₹1,000—reduced. |

* Listed alongside goods in the source table.

| Sector | No. of Items (approx.) | Old Rate | New Rate | Remarks / Coverage |

|---|---|---|---|---|

| Renewable Energy | 4 | 12% | 5% | Solar cookers, solar water heater systems, biogas plant, windmills, fuel-cell motor vehicles, etc. |

| Textile Sector | 45 | 12% / | 5% | Sewing thread, synthetic / artificial yarn, carpets & other textile floor coverings, textile wall coverings, etc. |

| Education | 6 | 5% / | Nil | Erasers, pencils, sharpeners, maps, exercise books, notebooks (all types), mathematical boxes, colour boxes, etc. |

| Common-man Items | 31 | 12% / | 5% | Tooth powder, candles, cotton handbags, umbrellas, household articles, furniture, etc. |

| Paper Sector | 20 | 12% | Nil / | Mechanical wood pulp; boxes, pouches, wallets, paper sacks, etc.; chemical/greaseproof/glassine papers—some moved from 12% to 18%. |

| Transportation Sector | 23 | 28% | 18% / | Tyres of rubber; tractors; motor vehicles; petrol seats; boats; motorcycles >350cc, aircraft for personal use, yachts for sports—some shifted from 28% to 40%. |

| Sports Goods & Toys | 5 | 12% | 5% | Playing cards, sports gloves, chess boards, fishing rods, etc. |

| Defence | 2 | 12% | 5% | Two-way radios (walkie-talkies), tanks and other fighting vehicles. |

| Sector | No. of Items (approx.) | Old Rate | New Rate | Remarks / Coverage |

|---|---|---|---|---|

| Transportation | 8 | 12% | 18% | Air transport of passengers other than economy class; transport of goods by GTA; renting of motor vehicles, etc. |

| Job Work | 6 | 12% | 5% | Job-work services related to umbrellas, printing, bricks, skins & leather, etc. (Other job-work services move from 12% to 18%.) |

| Construction | 3 | 12% | 18% | Composite supply of works contract involving oil & gas exploration, predominating earthwork, etc. |

| Local Delivery via ECO | 1 | — | 18% | Supply of local delivery services through e-commerce operators (ECO). |

| Other (reduced) | 5 | 12% | 5% | Goods carriage insurance, low-priced movie tickets, hotel accommodation up to ₹7,500/day. |

| Other (increased) | 3 | 12% | 18% | Services related to petroleum exploration/mining; beauty & wellness services. |

| De-merit Services | 4 | 28% | 40% | Casino/race-club entry, licensing of bookmakers, betting/gambling, etc. |

Rate Change Impact on Transactions and ITC Balance

The Goods and Services Tax (GST) framework is dynamic, with frequent changes in rates of goods and services based on policy decisions, revenue considerations, and socio-economic priorities. Any change in GST rate—whether an increase, decrease, exemption, or fresh taxability—has a cascading impact across the supply chain, from manufacturers to dealers, and ultimately the consumer. For manufacturers, rate changes alter output liability, working capital requirements, and input tax credit (ITC) adjustments, directly affecting profitability and compliance. Dealers and traders face the challenge of aligning purchases, sales, and ITC reversals or availment, while ensuring correct invoicing to avoid disputes.

Customers, particularly unregistered end consumers, experience these changes in the form of price variations, with benefits or burdens depending on whether the tax rate has decreased or increased. It is crucial to carefully examine the timing of supply, issuance of invoice, and receipt of payment as governed by Section 14 of the CGST Act, since these factors determine whether the old or new rate applies. Additionally, ITC implications under Sections 16, 17, and 18 must be handled diligently to avoid reversals, lapses, or ineligible claims. The table below simplifies these impacts, helping stakeholders anticipate changes, comply with law, and make informed decisions.

| Scenario | Manufacturer | Dealer/Trader | Unregistered Customer |

|---|---|---|---|

| 1. GST Rate Increases | Tax on transactions:

ITC Balance: remains valid. | Similar to manufacturer Cost of working capital may not be impacted much as it will be compensated by ITC with higher rate. | Before Rate Change: Lower tax burden. After Rate Change: Pays higher price including higher GST. |

| 2. GST Rate Decreases | Tax on transactions:

ITC Balance: Unaffected. | Similar to Manufacturer Cost of working capital may not be impacted much as it will be compensated by ITC with higher rate. | Before Rate Change: Pays higher tax-inclusive price. After Rate Change: Gets benefit of reduced GST if dealer passes on the benefit. (Sec. 171 – anti-profiteering measures will be put to test.) |

| 3. Supply Becomes Exempt | Tax on transactions:

ITC Balance: ITC on inputs, semi-finished, finished goods and capital goods (on proportionate basis) attributable to exempt supplies must be reversed (Sec. 18(4); Rule 44). ITC Availability: Blocked in respect of exempt supplies (Sec. 16). | Similar to manufacturer | Before Exemption: Pays higher tax-inclusive price. After Exemption: Goods/services cheaper (no GST) if dealer passes on the benefit. (Sec. 171 – anti-profiteering measures will be put to test.) |

Proactive Solutions

Navigate GST rate changes with confidence—secure compliance and protect profitability

CA Mahipal Sharma | Partner | FCA | CISA | B.Com

Contact: +91 7023030160 | email: mahipal013@gmail.com